Helping Hands for Childcare: Understanding the Additional Child Care Subsidy in Australia

Balancing childcare costs with a family budget can be a challenge in Australia. Thankfully, the government offers the Additional Child Care Subsidy (ACCS) to help eligible families. This article dives deep into the ACCS program, explaining its benefits, eligibility criteria, different types available, and the application process.

Table of Contents

What is the Additional Child Care Subsidy (ACCS)?

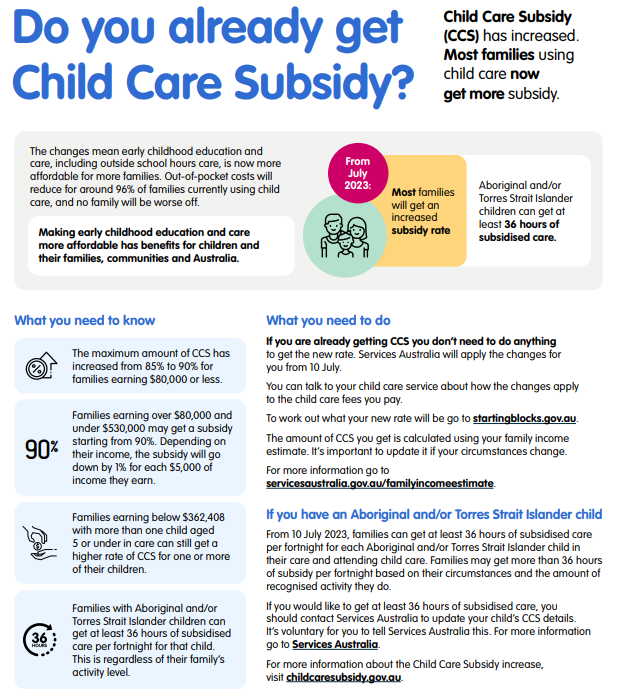

The ACCS is a financial boost on top of the base Child Care Subsidy (CCS) the Australian Government offers. It helps families manage the costs of approved childcare services for their young children. Think of it as an extra layer of support for those who need it most.

In many cases, the ACCS can fully cover the cost of childcare, easing the financial burden and allowing families to access quality early childhood education and care. This not only benefits children’s development but also provides parents with the peace of mind to work, study, or volunteer.

Who Can Get the Additional Child Care Subsidy?

The ACCS is not available to everyone. To be eligible, you must already be receiving the Child Care Subsidy (CCS). The CCS itself has its own eligibility criteria, including:

- Caring for a child aged 13 or younger (unless attending secondary school with an exemption).

- Using an approved childcare service.

- Being responsible for paying the childcare fees.

- Meeting residency and immunization requirements for your child.

On top of the CCS eligibility, there are additional criteria for different types of ACCS:

- Grandparent Subsidy: This is available for grandparents who are the primary carers of their grandchild and receive income support payments.

- Child Wellbeing Subsidy: This can be claimed by families who need extra support for their child’s safety and well-being. Specific situations may qualify for this subsidy, so it’s best to check with Services Australia for details.

- Temporary Financial Hardship Subsidy: This helps families experiencing temporary financial difficulties that are impacting their ability to afford childcare.

- Transitioning to Work Subsidy: This provides support for parents moving from income support payments into employment.

Types of Additional Child Care Subsidy

- Grandparent Subsidy:

- Are you a grandparent receiving income support payments (like Centrelink)?

- Do you look after your grandchild as their primary carer?

- If you answered yes to both, then you might be eligible for the Grandparent Subsidy. This subsidy recognizes the important role grandparents play in childcare and helps ease the financial burden.

- Child Wellbeing Subsidy:

- Is your child considered vulnerable or at risk of harm, abuse, or neglect?

- Do you need extra help to support your child’s safety and well-being?

- The Child Wellbeing Subsidy can provide additional financial assistance for childcare in these situations.

- Temporary Financial Hardship Subsidy:

- Have you encountered unexpected financial difficulties that make it hard to afford childcare?

- The Temporary Financial Hardship Subsidy can offer temporary relief. There are income and activity tests to determine eligibility, so it’s best to check with Services Australia for specific details.

- Transitioning to Work Subsidy:

- Are you a parent moving from income support payments like Centrelink into work?

- The Transitioning to Work Subsidy can help with childcare costs during this period, making it easier to focus on your new job.

How Much Additional Child Care Subsidy Can I Get?

The amount of ACCS you receive depends on the specific type you qualify for and your individual circumstances. The Grandparent and Transitioning to Work Subsidies typically provide a set hourly rate to help cover the cost of childcare. The Child Wellbeing and Temporary Financial Hardship Subsidies might be more flexible, with the amount determined based on your specific needs and assessed by Services Australia.

Applying for the Additional Child Care Subsidy

The good news is you can apply for the ACCS online through your myGov account. Here’s a simplified breakdown:

- Sign in to your myGov account.

- Select “My Family“.

- Under “Child Care,” choose “Child Care Subsidy Summary“.

- Click on “Add child to Child Care Subsidy” and follow the prompts to complete your claim.

If you don’t already have a myGov account, you can create one online. It’s a central platform for interacting with various Australian government services.

In some cases, you might need to provide additional information or documentation.

Understanding the Additional Child Care Subsidy in Australia can significantly alleviate the financial strain on families and ensure children have access to quality childcare. Whether you’re a grandparent, a parent in transition, or facing temporary financial difficulties, exploring your eligibility for the ACCS could make a world of difference in your childcare journey.