The Social Security System Contribution Table, also called SSS, is a table showing the amount of contribution that needs to be made by eligible candidates monthly. The SSS Contribution Table is released every year along with the new changes. Here, we are going to provide information regarding the SSC Contribution Table for the year 2024.

It has been reported that many citizens of the Philippines are not happy with the new rate introduced by the government for contribution. Scroll down the page and get information regarding the SSS Contribution Table like new changes and more.

Table of Contents

SSS Contribution Table Statistics and Changes

The following are some of the key changes seen in the SSS Contribution Table:

- Contribution Rate Increment: The SSS introduced a contribution rate of 14% for the 2023 year. Previously, the rate was 13%. The mentioned increases are stated to be a part of the scheduled series of rate hikes as per the Social Security Act of 2018.

- Monthly Salary Credit Changes: Apart from the increment in the SSC contribution rate, an adjustment in the Monthly Salary Credit has also been noticed. The minimum MSC has been set at PHP 4,000. Whereas. the maximum MSC has been hiked to PHP 30,000.

- Extension of Fund Life: Both of the adjustments mentioned above have affected the Project Fund Life of the Social Security System as well. According to the official reports, it is anticipated that the SS fund life will extend and last until the 2054 year. Overall, it is going to offer an extended period of benefits to eligible beneficiaries.

- Future Plans: It is aimed that the Social Security System will increase the rate of contribution gradually to 15% by the end of 2025 year. It will ensure the viability of the long-term along with the good financial help of the respective fund.

SSS Contribution Table 2024

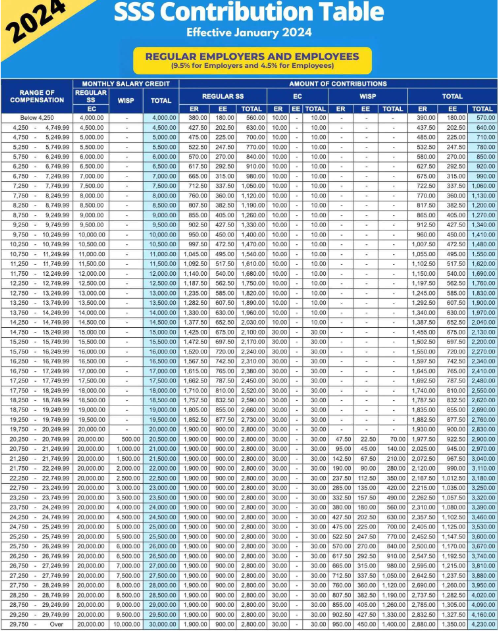

SSS Regular Employers and Employees Contribution Table

Employers, also called ER, are the ones who hire employees. Employers are responsible for the reduction of SSS contribution to the salaries of their employees. Employers must repeal the contribution with their share to the SSS on their employees’ behalf.

Employees, also called EE, are individuals who get hired by the employer who provides a portion of their salary to the SSC. The employees get the salary after the deduction of SSS into their account. This deduction is essential for the SSS benefits. For example, disability, maternity, sickness, and others.

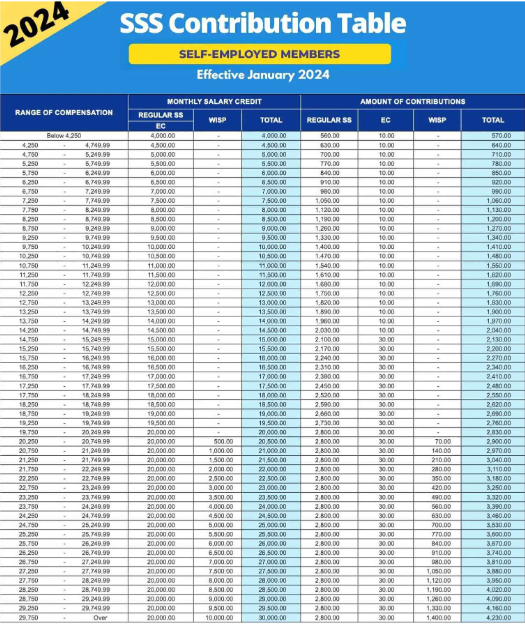

Social Security System Self-Employed Contribution Table

Individuals who work for themselves are known as Self-Employed Members. It does not include the employer-employee relationship. Freelancers professionals, entrepreneurs and others come under the self-employed category. Self-employed should make regular contributions to the SSS fund which helps them with sickness, death benefits, maternity and others. The contributions are calculated considering the mentioned monthly earnings.

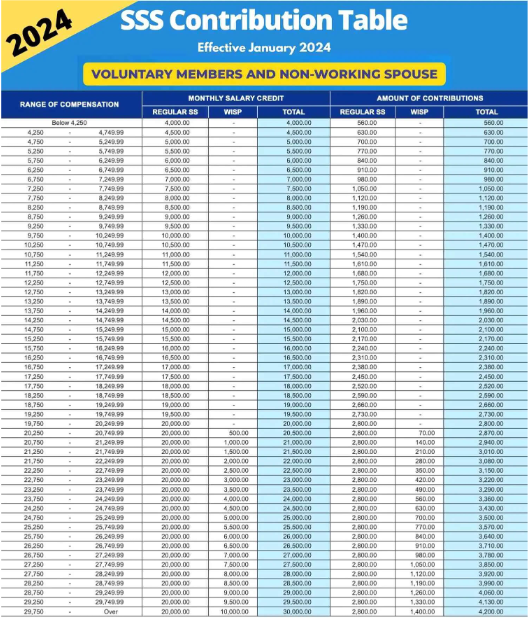

SSS Voluntary Members and Non-Working Spouse Contribution Table

Individuals who are not employed formally and are self-employed but voluntarily decided to contribute to SSS are known as Voluntary Members. Non-working spouse is a partner who does not do any activity that helps in generating income or they are not employed formally but is married to a member of SSS.

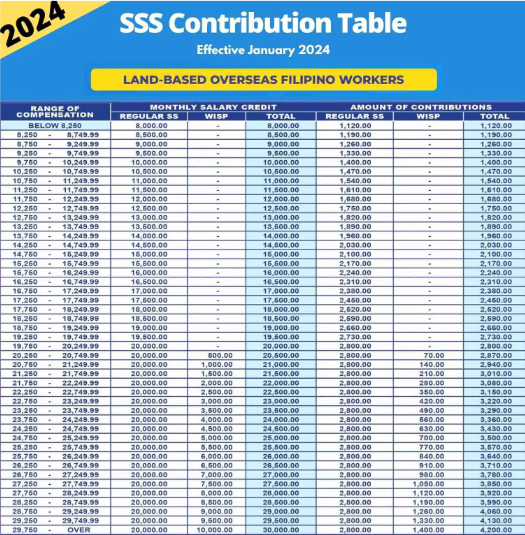

Land-Based Overseas Filipino Workers SSS Contribution Table

OFWs who are employed in different land-based capacities abroad. The availability of SSS contributions allows them to get benefits of social security and financial assistance during the period of employment and upon their return to the country.

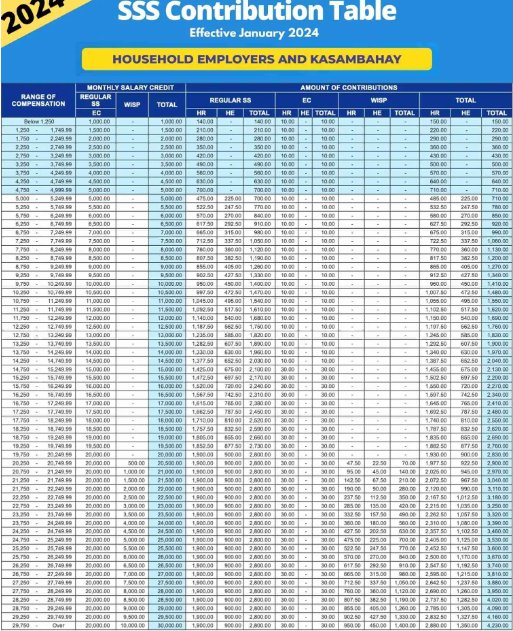

SSS Household Employers & Kasambahay Contribution Table

Household Employer and Kasambahar is the relation between the household employer and domestic worker. The household employers must register their respective Kasambahay to the SSS to offer the benefits of social security.

Frequently Asked Questions

What is the new rate in SSS Contribution Table 2024?

So the employer’s share of the contribution has been increased by the concerned authority to 9.5%. Whereas, the employee’s share has remained at 4.5%.

Who can contribute to the SSS?

Candidates who are employed by their employers will be responsible for remitting the SSS contribution. In case candidates are self-employed individuals, then they can pay the SSS contributions online.

What is the deadline to contribute to the SSS account?

The last day of the month following the applicable month is the deadline to make a contribution to the SSS account for regular employers, household employers and self-employed.